-

#HealthcareCase

StudyTest Automation Framework for a Leading Non-Profit Organization

Abstract To compete and thrive in this market, the non-profit organization wanted to deliver quality services. As businesses become more app-driven, there was an increasing focus on testing. Poor test quality, scant test coverage, and the lack of appropriate test environments, enterprise test automation strategies were hindering agile delivery. Discover how Cigniti’s customizable Test Automation Framework reduced app test cycle execution time ensuring agility and efficiency.Download the Collateral

-

#BFSICase

StudyImprove Test Coverage with Digital Transformation Services

Abstract Delivering critical services at the juncture of expansion was becoming a challenge for a leading Financial services provider. Applications that used to support quick service were becoming complex, inefficient, and error-prone. This required comprehensive end-to-end testing. Discover how Cigniti’s digital advisory and transformation services expertise chalked out a PoC to reduce test cycle time and improve test coverage. This ended up reducing time to market and enhancing on-time delivery.Download the Collateral

-

#BankingCase

StudyProactive QE™ powered success of a Digital Banking Platform

Abstract The NCR D3 Digital Banking Platform offers flexibility, scalability, and agility to digital-first banks powered by NCR. To accelerate time-to-market and reduce costs by enabling faster feedback on new releases and shifting-left, NCR D3 needed to integrate real-time, unattended regression testing that covered 75% of core functionality into their Agile SDLC Practice. Learn how NCR D3 achieved 100% unattended automation of 300+ core functional tests and parallel execution of up to 20 tests by leveraging Cigniti-Tricentis partnership and the power of Proactive QE™.Download the Collateral

-

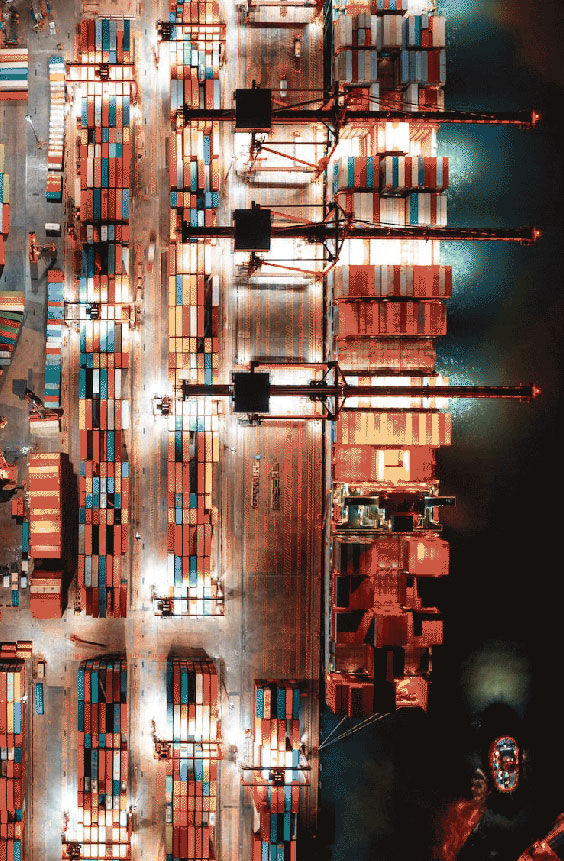

#LogisticsCase

StudyEnd-to-End Testing with iNSta for a Scrap Metal Trader

Abstract A world leader in scrap metal recycling and trading was facing challenges with their existing automation solution due to outdated scripts and complex MS Dynamics 365 integrations. Leveraging iNSta, Cigniti’s AI-powered scriptless test automation platform, the team automated end-to-end testing and achieved 90% overall test coverage. The implementation of DevOps for test management and the development of detailed reporting dashboards also increased visibility to key stakeholders, allowing them to make informed decisions for production.Download the Collateral

-

#Digital EngineeringWhite

PaperWhy Data Modernization is the Key to Accelerate Enterprise Digital Transformation

Abstract Sourcing, interpreting, and consuming data is becoming a challenge for most enterprises. Are you willing to take the risk of falling behind competitors who can derive actionable insights from the data and deliver outcomes? Modernization of data promises to overturn this. This white paper addresses these challenges and advocates how a robust data modernization strategy can help not only derive a competitive advantage but also leverage the true power of collaboration.Download the Collateral

-

#BankingCase

StudyLeading Bank Reduced Credit-loss Rates & Enhanced Efficiency Through Credit Risk Model Validation

Abstract A bank devised a framework to validate its credit risk model. It took time to validate the concept and comprehend its usage throughout the spectrum of consumers. With this, the validation requests grew and responses to backlogs spiked. Discover how Cigniti’s digital engineering and digital insights expertise helped chalk out an assessment strategy to identify potential gaps to streamline the credit risk model validation process. This reduced credit-loss rates, making significant efficiency gains.Download the Collateral

-

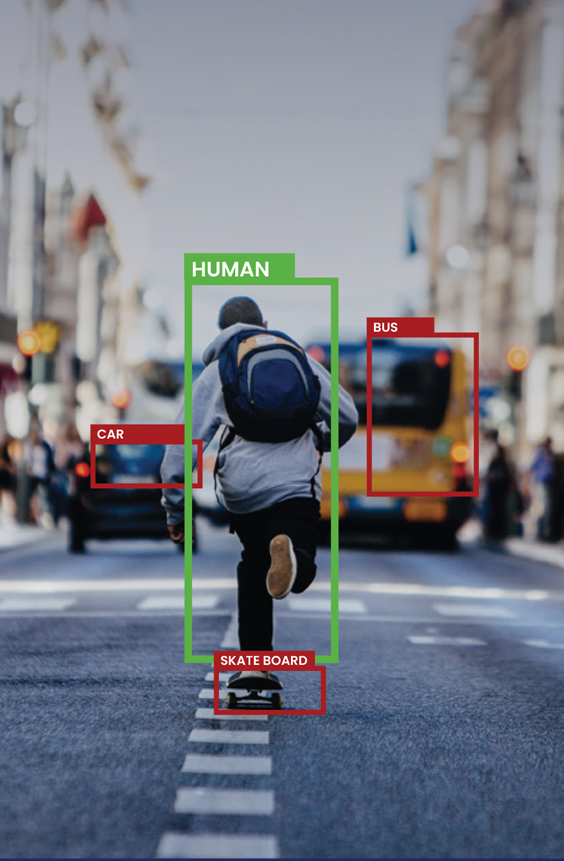

#AllWhite

PaperHow to Build a Scalable Data Annotation Pipeline with Zastra

Abstract Poorly processed data is cited as one of the major reasons that machine learning projects fail. Your training dataset's construction, formatting, and annotation all directly affect the model you develop. When trying to scale annotation pipelines, enterprises face substantial challenges. Read this white paper on how an active learning-based, end-to-end data curation and annotation platform - ZastraTM - can address these challenges.Download the Collateral

-

#AllBrochure

Data & Insights

Abstract Today’s organizations lack in-house teams and technological expertise that are focused on preparing data and generating insights. The perceived cost of execution, complexity, dependence on deep-rooted legacy systems, the sheer volume of data, and lack of systems and processes make it difficult for organizations to achieve the right insights, thereby limiting their true potential. Read the brochure, to know how Cigniti can help you to make your decision-making process faster and more accurate by providing a full range of Data & Insights services.Download the Collateral

-

#Artificial IntelligencePodcast

How to start an AI Project – Baby Steps or Giant Leap

Speakers: Srinivas Atreya, Chief Data Scientist, Cigniti -

#BankingCase

StudyCustomer Lifetime Value Model for a Leading Banking & Financial Group

Abstract A marketing metrics study reveals that the probability of selling to a new prospective customer is 5%–20%, when compared to an existing customer is 60%–70%. A large banking and financial group wanted to enhance its revenue by retaining its customer base, assessing customer value, and targeting them with the right set of tailored products. Discover how Cigniti devised a Customer Lifetime Value Model for the bank and accelerated its customer retention and revenues.Download the Collateral

-

#HealthcareCase

StudyA Mobile-First Digital Platform to Help Automate P...

Abstract Longer wait times may have an impact on patient care and may refrain them to seek medical attention. This may affect the continuity of care and disrupt patient outcomes. To mitigate this challenge, a healthcare provider wanted to integrate patients, practitioners, and field workers on a single platform for faster and frictionless treatment. Discover how Cigniti devised a digital platform that streamlined the manual & fragmented processes into connected, automated ones providing accessibility and personalized care.Download the Collateral

-

#AllWhite

PaperWhy is API Testing Important for Open Banking

Abstract

Open banking is a technology-enabled financial services that utilizes authenticated and aggregated data, connected via APIs, to give consumers more ways to manage their money while also making transactions more secure.This white paper sensitizes the decision-makers in open banking on how to identify and resolve the challenges that open API pose, harnessing the best digital assurance practices.

Download the Collateral

- Industries

- Digital Assurance Services

- Digital Engineering Services

- IP & Innovation-Platforms

- BlueSwanTM

- Verita – Quality Engineering Dashboard

- Velocita – Test Automation Accelerators

- Praxia – Process Accelerator

- MAP – Model Assurance Platform

- CLAP – Cloud Migration Assurance Platform

- iNSta – Intelligent Scriptless Test Automation

- Cesta – Integrated Migration Solutions

- Incight – App Experience Analyzer Tool

- ZastraTM

- Labs

- BlueSwanTM

- Resources

- About Us