The Mobile Payment Revolution – Test it Out!

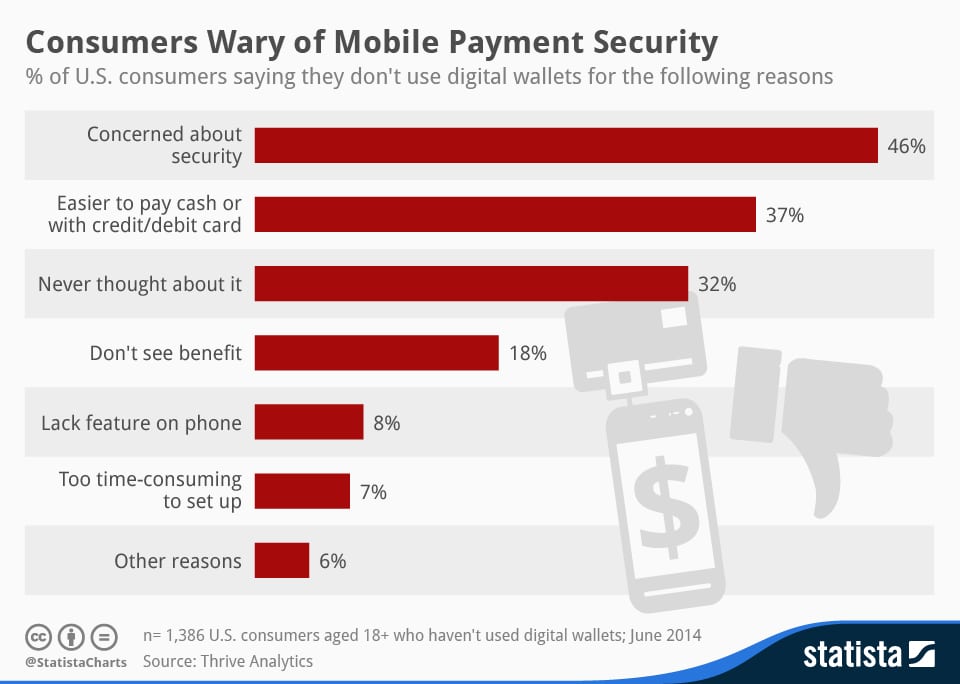

Mobile Payments or Mobile Wallets – have become highly convenient payment methods. No risky cash, no bulky plastic cards; all you need is a smart phone and hello ecommerce! But the recent launch of Apple Pay seems to have reignited interest and given a new turn to the Mobile Payment revolution. Old horses like Google wallet, Paypal, ISIS etc. have definitely been around for some time. True, mobile payment applications are considered the future of retail; but consumers seem to have their own set of concerns. This Statista survey highlights these concerns:

Though issues like “Never thought about it” can be addressed by marketing the benefits of mobile payment over cash or credit/debit card transactions, the others can’t be shaken off that easily. To get to the core of these concerns, we have to get down to how the application is developed and tested. Testing the mobile banking application is an absolutely can’t-do-without crucial factor in ensuring that you soothe away all your consumer’s concerns. So for now, let us look at some futuristic trends surrounding mobile payments and how mobile testing plays a critical role in its success.

One Click Checkout

Though Apple Pay has sort of revamped the mobile payment sector, it isn’t the first and only mobile payment option out there. Google wallet and Paypal, the old contenders, are still going strong and are very much in the game. The competition is tough and add to that the fact that at least 37% of the populace still think cash and card transactions are much easier to deal with. To win their vote, it’s going to have to get real easy and a one click checkout mobile payment option is as easy as it can ever get. So kudos to the industry for thinking that up! Here is where Functional Testing will play a crucial role, with aspects like End to End Testing, System Interrogation Testing, User Acceptance Testing etc… This will ensure that such a product feature meets the high standard that consumers expect from a mobile payment application. If all goes well, that will have the 37% in the bag!

Security

Definitely one of the topmost concerns when it comes to mobile payment applications. This seems to be a major concern for big guns in the banking industry as well. But the days of fretting over this predicament seem to be numbered. The industry is all set to welcome some really innovative solutions that promise to have the security problem all wrapped up. Features like fingerprint scan login, retina verification login are being incorporated, which helps ensure that only the right user can login into the account. Also, using wearables like heartbeat or motion sensing devices which enables an auto logout of the session if the user is away from his device or if the session is inactive for long. Even the concept of tokenization of mobile payments is being considered. However, all of this would need an extensive and thorough testing, not the least of which is mobile testing to check device compatibility and functionality support along with automation testing and performance testing. Security guaranteed = Happy customers!

Mobile payment is looking all poised to rule the future. And Cigniti is proud to be right in with it. Check out the many success stories that prove the point. We have the tools and the expertise which can help deploy the right strategy to make the future of mobile payment more simple and secure.

Register for an informative and thought provoking webinar on Jan 21, 12:00 PM EST to learn how Cigniti & Experitest can help you assure software quality and succeed in the digital age to provide world class experience to Mobile Banking customers.

Leave a Reply