The Impact of Digital Transformation on the Insurance Industry

Whether a company is small or large, digital transformation is essential. Every lecture, panel discussion, article, and study about how firms can stay competitive and relevant as the world gets more digital makes that point loud and clear.

Many corporate leaders are unsure of what the term “digital transformation” actually entails. Is it merely a memorable way of saying “going to the cloud”? What concrete actions do we need to take? Do we need to hire a consulting firm or create new positions to assist us in developing a framework for digital transformation? What elements of our business plan require modification? Does it merit it?

The insurance sector is radically changing due to digital transformation. The majority of insurers are making significant investments in digital technologies. If you’re not one of them, your competition will surpass you rapidly.

The global shift to digitalization is having a daily impact on carriers across the insurance spectrum, both in terms of business and the marketplace. Some insurers are still hesitant to fully embrace digital transformation.

Others, however, are seizing this once-in-a-lifetime opportunity to broaden their consumer base and market. We increasingly take technology for granted since it is so interwoven into our daily lives. The four Cs of the marketplace—Customers, Competitors, Costs, and Compliance—are the driving forces behind this digital disruption to business as usual.

Stricter regulations, rising capital costs, escalating competition from fast digital upstarts, and poorer returns on invested assets are just a few of the difficulties the insurance business currently faces. Additionally, as the real and digital worlds merge more quickly, insurers must deal with the fast changing expectations of their customers for individualized goods and services, omnichannel engagement, etc.

Given these obstacles, the sector must actively embrace digital transformation if it is to be relevant and competitive in a market that is rapidly changing.

Reimagining traditional business and operating models is necessary to include crucial operations like underwriting, claim resolution, and customer service. Insurance companies may do this with the aid of three disruptive technologies: artificial intelligence (AI), the Internet of Things (IoT), and blockchain.

The impact of AI, IoT and Blockchain on the Insurance Industry

- Improved underwriting accuracy

- The dynamic insurance pricing model

- Automated underwriting and claim processing

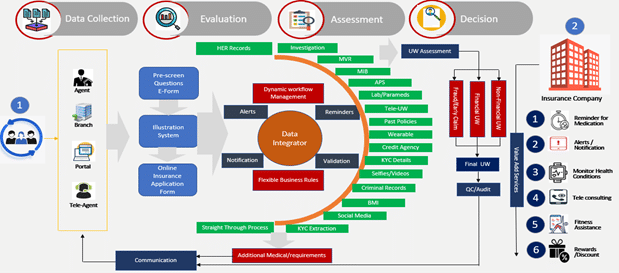

Improved Insurance underwriting process- through AI

By expediting underwriting procedures, assigning work to human attention, providing better data-informed insurance policies more quickly, and enhancing customer experiences, AI technology can boost efficiency and automate workflows.

AI can use digital financial data, credit histories, and other sources to create underwriting suggestions. It can gain access to various sources of data and use them to inform the underwriter’s choice.

Underwriters will be able to more effectively examine a customer’s application for insurance coverage and look for signals that indicate risk and financial viability. They can also look over a claim and determine whether it is legitimate, determining whether it fits the requirements for a payout or raising a red flag if it appears to be fraudulent.

Large volumes of applications or claims can be analyzed in bulk by AI, which can also swiftly classify them, compare them using data analytics, and spot trends and abnormalities. As a result, underwriters have more knowledge about all of their clients, which enables them to make wiser decisions.

Numerous top insurers use machine learning (ML) algorithms and sophisticated data analytics to mine massive amounts of data gathered from numerous sources, increasing the accuracy of risk assessment. Cross-selling and fraud detection are made possible by machine learning (ML) tools, which quickly aggregate and evaluate large datasets gathered from telematics, IoT, social media, drones, MIB, DMV, and other traditional third-party external systems.

Insurers can now process and resolve claims accurately and promptly for greater customer satisfaction thanks to audio, image, and video analysis, which is the third important way artificial intelligence in insurance is revolutionizing the sector.

For instance, a person with auto insurance can use their mobile app to instantly make a claim in the event of an accident by uploading photos of the incident. Self-learning algorithms can then determine the level of damage and automate the claims assessment process by collecting pertinent claims-related data from photographs.

Automated underwriting processing through AI

Automated underwriting processing through AI

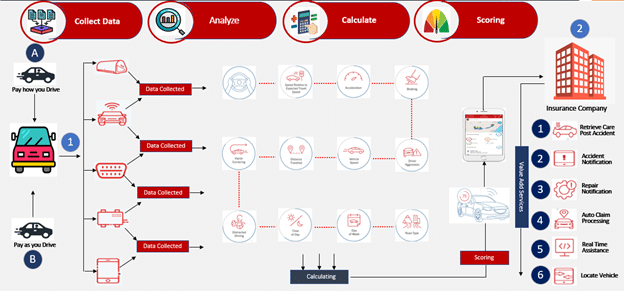

Dynamic Insurance pricing model- through IoT

IoT technologies are anticipated to alter conventional insurance business models, including how insurers interact with their clients and how they assess and manage risk on a fundamental level. The amount of data that can be evaluated to price risks is being produced at an unheard-of rate in today’s hyperconnected society.

The proliferation of sensor-based smartphones, wearables, and “smart” household appliances has created numerous business prospects for insurers in the ever-expanding IoT market.

By extracting useful information from multidimensional consumer data, payers can create more precise actuarial models to customize underwriting. For instance, they may create high-quality, dynamic risk profiles using real-time behavioral and contextual client data rather than proxy measures like credit scores.

It is feasible to identify four significant ecosystems (Connected health, Connected automobiles, Commercial lines, and Smart homes) that hide great potential based on the emerging Internet of Things trend in the insurance business, digital disruptions, and overall attractiveness of insurance services.

Making customized goods and services are another way that IoT can be used in the insurance industry. Usage-based insurance (UBI), which bases premium discounts on a person’s driving habits, may be used by auto insurers to introduce customized products. As a result, if a policyholder acts recklessly, sensors installed in the vehicle would quickly detect it and send it to the insurer’s IoT platform for an appropriate premium increase.

Usage-based vehicle insurance (UBI) replaces the conventional method, which relies on statistics to evaluate the risk factor of a certain driver, by using personalized data collected by IoT sensors to calculate insurance rates. UBI systems keep track of a driver’s compliance with safe driving practices. They factor in the number of miles a car is driven frequently when determining premiums, frequently offering drivers considerable savings.

Last but not least, insurers might use IoT to develop new services like car maintenance notifications, vehicle recovery, and emergency roadside assistance.

Usage–based insurance (UBI) through IoT

Usage–based insurance (UBI) through IoT

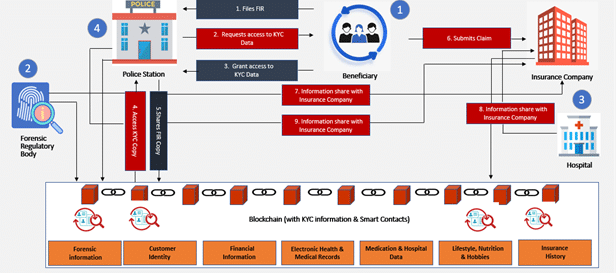

Automated underwriting and claim processing- through Blockchain

While blockchain applications in the sector are still in their infancy, AI and IoT are already helping insurers achieve business goals. However, distributed ledger technology has a lot of potential for fostering end-to-end accountability, transparency, and strong data security.

Blockchain technology has the potential to significantly help insurers and their clients in a number of areas, including claims processing, fraud detection, reinsurance, and peer-to-peer insurance. It is obvious how the usage of blockchain technology might affect product creation, underwriting, claims management, and administration. One important advantage that blockchain might offer is cost savings. Today, efforts to cut costs have been a major focus of many blockchain use cases. The first areas that insurance firms are thinking about include leveraging blockchain to automate the payment of claims. By confirming coverage between businesses and reinsurers, blockchain can aid in the automation of claims procedures. Additionally, it will automate payments for claims between parties, which will cut insurance firms’ administrative expenses.

The transfer of any digital proof for underwriting, including the use of electronic health information, is another potential use for blockchain (EHR). We can anticipate future adjustments in other pricing and product development sectors as digital evidence is simpler to include in underwriting. In the near future, our industry will look drastically different as a result of the Internet of Things (IoT) and Artificial Intelligence (AI) combining to automate insurance processes. These are still relatively new technologies, so adequate due diligence is necessary before the insurance business can fully benefit from them.

Detecting and monitoring fraudulent claims may be an important use of blockchain in the insurance sector. Distributed ledgers could be used by insurers and other stakeholders to quickly access and update pertinent information from claim evidence, third-party review reports, and police records for effective risk mitigation.

Automated claim process by using Blockchain

Automated claim process by using Blockchain

Approach to embracing digitalization

There are an overwhelming number of options given the size and speed of the drive toward digitization. Companies that want to succeed in the digital economy must adopt a systematic strategy that enables them to:

- Identify the correct use cases

- Digitalize the core operations

- Build a strategic blueprint

Identify the correct use cases

Firms must weigh the following three aspects when it comes to identifying and prioritizing the correct use cases:

Financial impact—assesses the impact on the bottom line of increased efficiency, Net Promoter Score, diversification revenues, and so on and the investment required to achieve this

Strategic alignment—measures how each use case contributes to the firm’s short-, medium-, and long-term goals and its overall vision

Ease of implementation—covers both internal and external aspects of implementation. Internal elements include existing capabilities and the availability of human capital. External factors include the availability and maturity of technology and the technology adoption rate by customers.

Digitalize the core operations

Digitalizing a firm’s core operations is a significant undertaking and serves two essential purposes:

- It enables people to focus on value-added activities by automating repetitive tasks

- It prepares the organization to absorb new initiatives in a seamless and efficient manner

Build a strategic blueprint

Even with established strategic objectives, realistic implementations require substantial planning. Companies were very clear on how, when, where, and why they wanted to implement various technologies in the most successful use cases we analyzed in our study before moving forward.

For instance, the AI use cases we looked at offer abundant proof that effective implementations need businesses to recognize the value of their data. A crucial step in making sure outputs are in line with business strategy is the process of cleaning and preparing data for use in training an AI engine. As a result, leadership, operators, and ecosystem partners must support and take responsibility for the pre-deployment data collection and preparation phase.

Companies develop and follow an executable road map that can help them realize their digitalization strategy. Three key steps underpin this approach:

Strategic blueprinting—Identification of providers for priority use cases and design of future interaction model and go-forward capability model, including a cross-functional digitalization centre of excellence

Testing the strategy—Actual or simulated transactions flowing through use cases to test, learn, pivot, and deploy

Implementation of solutions—Broader rollout and full-scale implementation of digital solutions across the business, spanning countries, business units/functions, and products.

Conclusion

As consumers want a convenient UX and simplicity in every product and service, digitalization will continue to advance. Insurance is not a disqualifier. As a result, this is the ideal time for insurers to dive in and quicken organizational digitalization. Of course, with opportunities come challenges, forcing management of the organization to fully recognize the market’s digitalization opportunities and gain the organization’s willingness to outsource a digital enabler to enable digital transformation, bridging the knowledge gap and creating a customized embedded solution.

With embedded insurance serving as the key to unlocking digitalization, insurance firms can choose to either be disrupted or to lead the disruption.

Cigniti supports global insurers in their digital transformation journey and helps them deliver an improved customer experience and gain competitive advantage.

Our customized services in insurance testing range across:

- Life Insurance (Life, Annuity, and Pension)

- Property & Casualty (P & C)

- & Auto

- Reinsurance segments

We make sure your apps and systems run seamlessly by ensuring efficient back-office operations. Our testing services portfolio and matchless track record prove us as a trusted advisor and preferred technology partner for insurance clients.

Need help? Contact our Digital Transformation and Insurance domain experts to learn more about the impact of digital transformation on the insurance industry.

Leave a Reply