Challenger Banks: Business Drivers and Success Imperatives

Challenger Banks are the new age banks that have come into existence riding on the waves of technological and regulatory enablement.

These banks, in general, are completely digital and don’t have a branch, saving loads of money, which makes the entire process convenient and cost-effective for the customer.

Every year, they are gaining more and more popularity and have already taken over some categories like payments and transfers.

In the banking domain, using emerging tech’s challenger banks’ core differentiators is driving innovation and improving customer service levels.

These banks build on the weaknesses of the incumbent large banks in terms of customer experience, legacy infrastructure, and slower adoption of industry trends while driving down the cost of service significantly.

Challenger banks are steadily making a dent in the customer base of the large incumbent banks by offering higher returns and value on their service offerings. The Neo Bank global market is estimated to be $627.99bn by 2028, growing at a CAGR of 47.17%.

The growing demand for superior customer experiences facilitated via digital channels has led to increased requirements for digital onboarding, contactless services, and engagement tools.

The introduction of Artificial Intelligence (AI) among challenger banks, coupled with the pandemic, served as a game changer in the way people avail banking services.

Benefits of Challenger Banks:

Digital or app-based banking has many more benefits. Some of these are that by not operating as an in-person branch system, they can avoid the high costs associated with it, which can be utilized into better services and innovation of products, and sometimes even by giving lower costs to customers.

While opening a bank account at any physical bank might take a couple of hours, with a digital bank, the process is done within a matter of minutes.

Not only that, they have been particularly thriving throughout the pandemic, and before, due to the way their customers are now able to access their banking needs through their mobile phones, tablets, iPads, or any computer systems from the comfort of their own sofas.

Challenger banks often come preloaded with different features too. Whereas with a challenger bank, you’re more likely to be able to use services that physical banks have yet to offer—like budgeting, tools, instant spending notifications, or even opportunities to invest your money.

Challenger banks also often come with bright, modern branding, with fun-colored debit and credit cards appealing to millennials.

By using BaaS, or Banking as a Service Infrastructure, they allay users’ fears about security. They often partner with traditional banks to provide better financial protection. On the cybersecurity side, challenger banking apps have built-in features such as fingerprint scanning instead of passwords or requiring two-factor authentication (2FA) to keep client information secure.

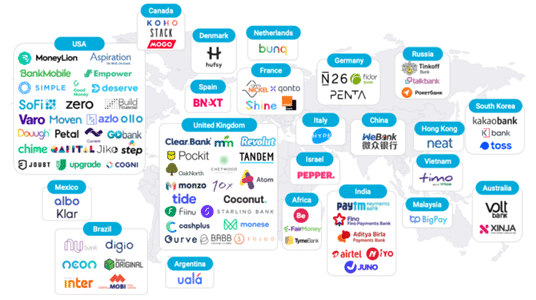

Challenger Banks across the Globe:

source: fintechnews.am

Business Drivers for Challenger Banks

Driver #1: Open Banking:

Seamless integration with banks and other service providers is highly imperative.

Open banking plays an important role in developing new services and integrating customer data with bank APIs available to third parties, which enables challenger banks to be more successful in the marketplace. Challenger banks adopt an open architecture, laying the foundation for the following:

- Online customer onboarding including account and ID verification, forms auto-fill, income verification etc.,

- Analytical approach such as creating dashboards, smart budgeting, and tips for savings to improve personal finance.

- Offer services such as accounting automation, financial data aggregation, and affordability checks to SMEs.

Driver #2: New Generation Technology (AI, ML, Blockchain):

Challenger banks are more interested in next-generation technologies such as artificial intelligence, machine learning, Blockchain, ISO 20022, and so on.

An advanced data analytics solution for challenger banks allows them to: collect data regarding customer preferences; set fraud prevention software; and introduce risk management algorithms.

For a customer, the benefits are even more appealing, as it helps them to analyze their spending, set recurring payments, get an idea about their financial needs, get individualized fiscal advice, and ameliorate their fiscal knowledge, resulting in overall financial improvement.

Artificial Intelligence and Machine Learning:

By introducing Artificial Intelligence and Machine Learning, the challenger banks managed to hugely boost their service offerings, improve their internal processes, and help meet the requirements of industry compliance while effectively introducing new solutions.

Here are a few typical use cases for these technologies:

- Credit scoring and churn prediction

- Process control and optimization (PCO)

- Customer service/chatbots

- Improved fraud prevention

- Personalized offerings and services

Blockchain:

Blockchain technology is another area that Fintechs and Neo Banks can leverage, with some of the major areas that will benefit from adoption of this technology being customer identification, trade facilitation, fraud management, P2P transfers, and syndicated loan services.

All of these technologies have significantly boosted the development of fintech, which results in speeding up the process of fintech becoming challenger banks.

Driver #3: Higher Quotient of customer experience and demand

Consumers have more options than ever, and they continue to demand to have these options in all industries, which applies to banking as well. Maintaining higher levels of customer experience (especially for new age customers) such as convenient, easy, hassle-free solutions is key to business growth and retention.

Driver #4: Cloud-based infrastructure

Today’s technology has made it much easier for challenger banks to get started. Digital banking couldn’t exist without infrastructure services or the convenience of widespread technology. Keeping the costs down is vital for the survival of a challenger bank. Hence, cloud hosting, with its benefits of shared infrastructure and scalability on demand, is a natural choice.

Driver #5: Mobile and Digital Transformation

The introduction of mobile devices and the many apps that run on them has changed both consumer expectations and how they manage cash flow, access account information, and decide on loans and investments. Consumers like Challenger Banks because they typically offer an excellent mobile experience, low fees, and provide access to underserved areas.

Key Imperatives

The success and scalability of challenger banks requires a nuanced and focused strategic approach. Challenger bank success depends upon considering targets around the adoption of the latest technologies, culture, and business strategies. Technology is one of the main challenges faced by incumbent digital banks which requires large capital and look to leverage a plug-and-play design stack on underlying API integrations and microservices.

For banks, a far better client experience means a stronger customer relationship. This may also mean recognizing the necessity to fundamentally transform the operational processes. Numerous banks that commenced a journey of enforcing an innovative transformation program just before the pandemic found their transformation journey by anchoring crucial rudiments of bank transformation programs Challenger banks can build a strong brand that eventually translates into business and monetization.

Conclusion

Digital Banks today need to keep up with the ever-changing technology landscape and the 24/7 demands of customers. Banks must offer complete functionality in the highly diverse mobile and browser technology fragmentation, end-to-end validation of both front/back-end systems, & ensure a consistent multi-channel delivery experience, along with the best usability and compatibility experience.

Cigniti, with its experience of being the core banking digital transformation and testing partner for pioneering mobile-only banks in the US and UK, has vindicated its capabilities in areas such as omni-channel banking, retail banking, corporate banking, centralized banking, mortgages, cards, and payment gateways. Cigniti has in-depth experience in testing across diverse industry standard products such as T24, Finacle, Flexcube, Bancs24, and Vision Plus, and compliance with regulations such as BASEL, BCBS 239, SEPA, AML, FATCA, etc.

Need help? Talk to our Banking domain experts to learn more about the business drivers and success imperatives of challenger banks.

Leave a Reply