How Blockchain is Solving the Pain Points in the Payments Sector

Digital security has always been an issue for payment organizations and their customers. Transparent and immediate payment is the basic need. To enhance and popularize digital payments and be more customer-focused, payments need to be made easy, fast, and highly secure.

Blockchain technology has come up with the solution which addresses the payment security needs, transaction transparency and boosts the overall efficiency of financial transactions. The technology works on a no-intermediaries method that excludes the need for a primary regulator.

To understand this better, let us deep dive into a payment use case, its pain points, and how blockchain is solving them.

Use Case – Peer to Peer Cross border transaction

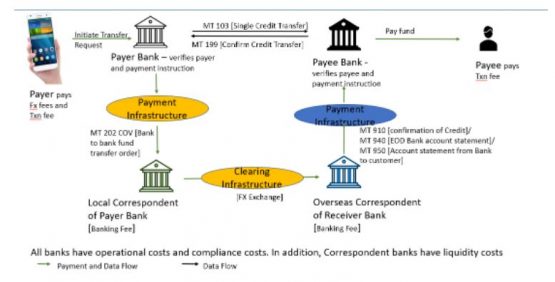

Below is the conventional flow where there is the Payer, Payer Bank, local payment infrastructure, local correspondent of Payer bank, Clearing Infrastructure, overseas correspondent of receiver bank, receiver side payment infrastructure, payee bank:

- Transaction Speed: It takes an average of three to five business days to complete a cross-border transaction. A significant time zone difference between the two involved currency jurisdictions plays a vital role. To settle each currency leg, the funds need to be transferred through the relevant domestic payment systems, and the operating hours of these domestic payment systems may vary across international time zones, hence delaying the settlement of the transactions.

- Transaction Cost: Sending an international payment through the existing banking channels is a complex, multi-step process that involves several intermediaries. Cross-border payments become expensive because banks often do not have direct relationships with one another globally. They, in turn, have intermediary banks to make indirect fund transfers. The intermediary bank charges a fee for this service, which it deducts from the total transfer amount. The remitter and the beneficiary both incur this cost, or either party needs to pay the complete amount. This fee is on top of the fees charged by the remitter bank or the recipient bank. For high volume cross-border payments, the charge is usually 2% to 3%. However, it can go up to 10% if payment volumes and values are low.

- Transaction Security: Different jurisdictions have different regulatory requirements, which introduce risk to a transaction. Additionally, when records are kept by each central authority participating in the transaction, like a bank, they are vulnerable to interference. If that authority is hacked, damaged, or taken offline, users could have their data compromised.

- Transaction Opacity: Since there are multiple participants in a single transaction, it is complex to track the payment while it is in transit. There is uncertainty about the final payment amount and scheduled delivery. It is also difficult to quickly track transactions with problems. This is due to the lack of an end-to-end system or rule set and the need to transact in different currencies across different time zones and comply with different regulatory requirements.

- Correspondent banking: The number of correspondent banking relationships is declining, particularly where transaction volumes do not justify the compliance costs to be borne by the bank and in jurisdictions where transactions may be high risk or where compliance is difficult to meet.

- Liquidity: Businesses or financial institutions could face liquidity challenges as well, with amounts sitting in nostro or vostro transactional accounts around the world, tying up the capital that could be used in more beneficial ways.

Now, with blockchain, the above challenges are resolved.

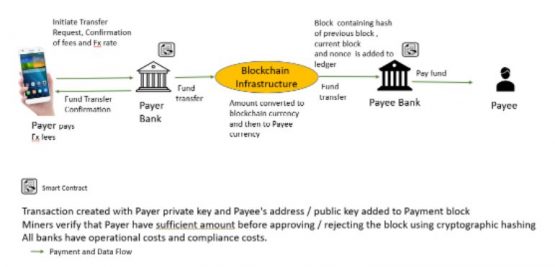

If you see the depiction below for cross-border implementation with blockchain, we only have the payer, payer bank, blockchain infrastructure, and payee bank:

- Transaction Speed: Blockchain payments are completed in near to real time – in seconds rather than days. The ability to transfer money instantaneously helps businesses be more responsive, acting on or addressing customer needs without waiting for funds to come through.

- Transaction Cost: Eliminating the need for intermediaries reduces the fees for sending cross-border payments. The fees paid by transacting parties are now limited to charges imposed by the distributed ledger technology-based solution operator. Companies using blockchain only need to pay a single nominal fee, which is almost nothing.

- Transaction Security: With blockchain technology, all transaction records are secured by cryptography, tied to previous transactions, and distributed among participants through a ledger. A channel-based private and closed communication is laid down among the participants (buyers, sellers, and peers) to endorse, validate, and commit transactions. Network participants have their own private keys assigned to the transactions they do, which act as a digital signature. If a record is altered, then the digital signature becomes invalid. This results in the peers identifying that something has occurred. Since blockchain is decentralized and operates across a peer-to-peer network, the ledger is updated and synched at all time amongst the participants. It means that there is no single point of failure across the ledger, and changing its state is almost impossible. Altering the data stored on the blockchain requires permission from up to 51% of the participants at the same time. Also, it requires enormous computing power to compromise the network. To tamper with the data, a hacker would have to alter all earlier transactions in the ledger.

- Transaction Transparency and Visibility: In a public blockchain solution, while the identity of a user is hidden, the transactions of each address are open to view. With an explorer and a public address, individuals, auditors, and regulatory authorities can view all transactions carried out by that address. On the other hand, in a private blockchain solution, the details are only viewable by permissioned participants involved in a transaction. All business logic is programmed as smart contracts on the network. All acknowledgements are captured as events, so there is complete transaction transparency and visibility.

- Data Integrity: Blockchain eliminates the risk of discrepancies in record keeping. As a decentralized ledger, it holds a verifiable and irreversible record of every transaction and distributes it across all authorized users to see. The ledger is maintained and updated communally by a group of connected computers, and all parties have an identical copy of the ledger. The use of distributed ledgers reduces data discrepancies, facilitates quicker reconciliation, and eliminates or reduces prolonged back office activities. Compliance is also simplified in a distributed ledger system.

- Encourages competition and innovation: The emergence of blockchain technology and blockchain-based payment firms has put pressure on existing cross-border payment institutions. This healthy competition will lead to innovation, which will be beneficial for end users.

- Immune to censorship by a central governing body: In peer-to-peer blockchain architecture, there is no strict control of a central governing body as of date, which is advantageous for such global transactions. Also, virtual currency wallets cannot be drained or frozen by banks or governments as of today.

From the above, we could see that implementing blockchain for cross-border peer-to-peer payments solves the pain points of the use case. All the major pain points discussed above and how they are being solved by blockchain are tabularized below.

| Pain Points of the Payment Industry | How Blockchain is solving it |

| Takes one to five days for successful transaction processing | Real time payments

|

| Multiple intermediaries create friction and bottlenecks | Zero Intermediaries |

| Expensive due to Commissions

|

Reduced Remittance cost to 2-3% of total amount |

| Some service providers charge 2 to 3% fee | Reduced cost |

| Lack of transparency | High degree of transparency |

| Save information, which might not seem safe | Security concerns addressed since decentralized |

| Denial of Service attack | Immune to Denial of Service attacks |

| Difficulty to support conversion to native currencies | Ease of currency conversion

|

| No Cross-border payments in case of in availability of correspondent banks | No geographical limitations |

Conclusion

Trust and transparency are the keys for payment transactions, and blockchain provides the same. However, enterprises that are going to adopt blockchain deal with privacy and security concerns, fear about the blockchain integration process, integration challenges with legacy systems, high energy consumption, and high initial investments.

Cigniti is one of the few IT service providers to have invested in a couple of its own blockchain sandboxes across Hyperledger Fabric and R3 Corda technologies. These sandboxes are designed to quickly create a viable prototype for any business application, providing a ready environment to test the viability of the concept and effectiveness of its configuration. Cigniti offers targeted testing services for applications that include comprehensive validation methods across API testing, functional and non-functional testing, integration testing, security testing, compliance testing, and performance testing, and also includes specialized testing features, such as peer/node testing and smart contract testing.

Need help? Talk to our Blockchain Testing experts to learn more about Hyperledger Fabric and R3 Corda, and identify the issues a typical blockchain project has, and how Cigniti can help with making the blockchain compliant.

Leave a Reply