Revolutionizing Hurricane Property Insurance: The Dynamic Duo of Imaging Data and Generative AI

What Is a Catastrophe Hazard?

A catastrophe hazard is a severe and widespread event that causes significant damage and financial loss. These events are frequently natural disasters or large-scale human-made incidents that affect expansive and contemporary claims. Catastrophe hazards pose substantial trouble to insurers, as they can lead to a high volume of claims within a short period, potentially impacting insurance companies’ financial stability.

Exemplifications of catastrophe hazards include:

Natural Disasters: Hurricanes or typhoons, Earthquakes, Floods, Tornadoes, Wildfires, and Tsunamis.

Man-Made Disasters: Large-scale industrial accidents, Acts of terrorism, and Nuclear incidents.

Understanding Generative AI

Generative AI is a subset of artificial intelligence that uses algorithms to induce new, realistic data predicated on patterns learned from datasets. In hurricane property insurance, Generative AI proves to be an essential tool for creating prophetic models and simulating probable scenarios, contributing to more accurate threat assessments.

In a period where technological advancements are reforming industries, the marriage of Generative Artificial Intelligence (Generative AI) and imaging data is revolutionizing the landscape of hurricane property insurance. This blog explores how the synergy between Generative AI and imaging data is propelling a new frontier in threat assessment, furnishing insurers with unprecedented insights and policyholders with further robust content against the uncertainties of hurricanes.

The Convergence of Generative AI and Imaging Data

Imaging data, deduced from satellites, aerial photos, and drones, combines forces with Generative AI to produce a robust frame for hurricane property insurance threat assessment. Generative AI, renowned for its capability to simulate and deliver data, is seamlessly integrated with high-resolution imaging data to bring a dynamic and comprehensive approach to hurricane property insurance risk assessment. By harnessing the power of these technologies, insurers can analyze, predict, and respond to potential risks with unparalleled accuracy.

Leveraging Imaging Data for Comprehensive Risk Analysis

Pre-Storm Property Analysis

High-resolution satellite imagery and upstanding photos offer insurers a detailed understanding of properties before a hurricane strikes. High-resolution images enable detailed assessments of property conditions, including structural integrity, landscaping, and proximity to potential hazards. The analysis extends to landscaping and the surrounding environment. Insurers can estimate the impact of near water bodies, trees, and other elements on the property’s vulnerability to hurricane-related damage. Generative AI processes this imaging data to identify vulnerabilities, assess structural integrity, and estimate potential risks associated with landscaping and geographic position.

Post-Event Damage Assessment

Drones equipped with imaging technology play a pivotal role in post-hurricane damage assessment. This data allows insurers to snappily and directly assess the extent of damage to insured properties, facilitating prompt claims processing. Generative AI processes the real-time aerial footage captured by these drones, expediting claims processing by directly determining the extent of damage to insured properties.

Data Fusion for In-Depth Analysis

By integrating imaging data with other sources, such as geographic information system (GIS) data, geocoded exposure data, environmental data, geospatial data, weather reports, and historical rainfall patterns, insurers can gain a further nuanced understanding of the risks associated with each property. This multi-dimensional analysis enables precise risk modeling and customized underwriting strategies.

Advanced Risk Modeling with Generative AI

Predictive Analysis

Generative AI takes prophetic modeling to new heights by evaluating historical imaging data, climate patterns, and property-specific details. This enables insurers to anticipate the implicit impact of hurricanes on individual properties, fostering a proactive and preventative approach to threat mitigation.

Machine Learning Algorithms

Machine learning algorithms, empowered by Generative AI, sift through vast imaging and historical claims data datasets. These algorithms identify nuanced patterns and correlations, offering insurers a deeper understanding of the multifaceted factors that impact hurricane risks.

Transforming Underwriting and Policy Design

Dynamic Underwriting Strategies

Generative AI’s continuous learning capabilities empower insurers to adopt dynamic underwriting strategies. This adaptability ensures that insurance policies stay current, reflecting the evolving risks associated with hurricanes.

Personalized Coverage

The amalgamation of Generative AI and imaging data facilitates the creation of highly personalized risk profiles for insured properties. Insurers can design policies that offer tailored coverage based on the unique characteristics and vulnerabilities identified through imaging analysis.

Innovative Policy Design

With a deeper understanding of risk factors, insurers can design further innovative policies. These policies may include dynamic coverage adjustments based on real-time hurricane tracking, ensuring property owners have the most relevant and effective coverage during critical periods.

Improve Risk Assessment & Underwriting

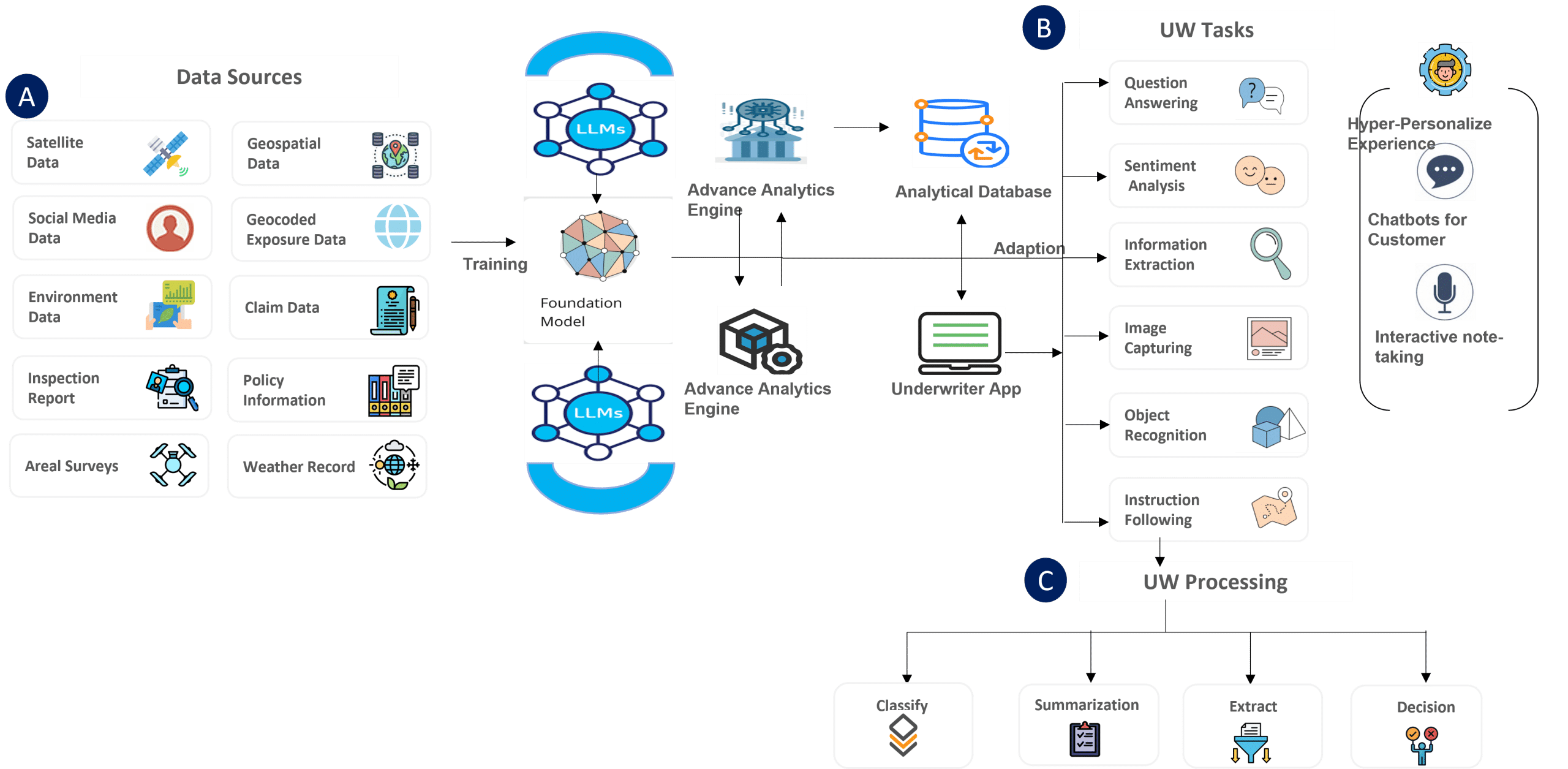

Risk Assessment and Underwriting Model through Imaging Data & Generative AI

Conclusion

The convergence of Generative AI and imaging data marks a pivotal moment in the evolution of hurricane property insurance. This dynamic synergy empowers insurers to make informed decisions while policyholders benefit from more accurate coverage that aligns with the unique risks associated with their properties. As this technological integration advances, the insurance industry is poised to enhance resilience and responsiveness in the face of hurricane threats, ultimately creating a safer and more secure future for at-risk communities.

Cigniti has end-to-end generative AI solutions that guarantee business participation by insurance companies in the AI landscape. Cigniti has extensive experience assisting in generative AI solutions (including testing) while considering the needs of insurance companies and helping them gain a competitive advantage. Cigniti’s testing and digital services portfolio and unparalleled track record have proved it a preferred technology partner for insurance clients.

Need help? Talk to our insurance domain experts to learn more about the opportunities the generative AI solution brings to the insurance value chain.

Leave a Reply