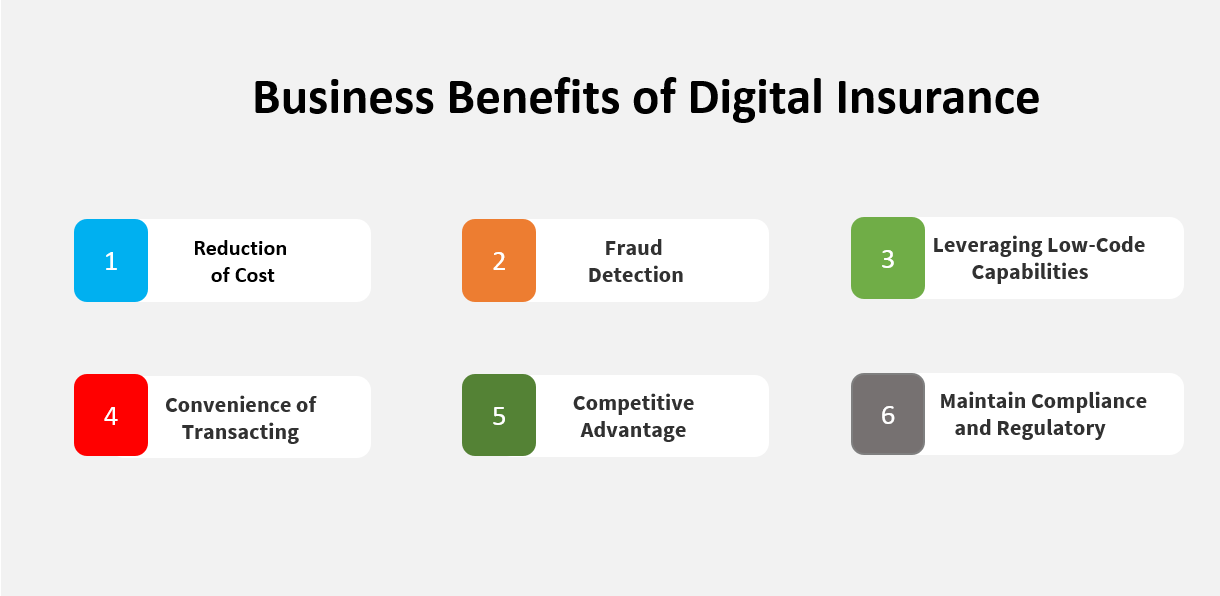

Top 6 Business Benefits of Digital Insurance

Digital technologies fundamentally shift how businesses across all industries operate and serve their customers; insurance is no exception. Many insurers today offer innovative digital technologies to meet the needs of their consumers. So, whether looking for health, life, auto, or home insurance, a handful of insurance companies can help you register easily through an app or website. Digital insurance models provide speed, agility, easy accessibility, and a user-friendly interface.

Digital technologies are giving rise to ecosystems that could allow insurers to extend their reach or partner with companies in other industries. Insurers can differentiate themselves by providing an excellent customer experience across multiple contact points. At the same time, shareholders expect to earn their fair share of the digital dividend.

What is Digital Insurance?

Digital insurance is the computerization of traditional insurance services. Digital insurance means digitizing all the insurance operations and replacing the insurance’s physical presence with an online presence, abolishing a consumer’s need to visit a branch.

Digital insurance empowers customers to access various insurance products and services via an electronic or online platform. These platforms use online customer service and digital algorithms to write price policies. Most insurance companies have a separate digital business wing for digital insurance platforms while following traditional practices. Digital insurance service providers have the following differentiators:

- Customer-centric approach to business transactions

- Quickly adapt to changing customer needs

- Enhance the customer experience by delivering innovation to policyholders and agents

- Modernized infrastructure to simplify integration with third-party apps

- Enhance integration of core functions, speeding up the delivery of information to lines of business.

- Insur-tech ecosystem in place where appropriate pricing, risk assessment, and handling of claims are processed with open, connected software platforms.

1. Reduction of Cost

Technology has bridged the gap between the insurance company and the customer to a large extent. This is likely due to the standardization and availability of instant and comparable information. The traditional marketing method, which involved high operating expenses, especially in advertising and infrastructure, has been considerably reduced due to digital marketing. With a cost advantage, insurance companies can pass on the benefit to customers. Without an agent or a broker, there is direct contact between the insurer and the customer. The digital omnichannel presence will assist the customer in researching and understanding the brand without waiting to speak to a representative.

2. Fraud Detection:

Insurance fraud is a persistent problem that has not shown signs of slowing down. It constantly advances as the types of deception become more diverse. The benefit of digital insurance applications is the volume of data that they generate. While generally positive data helps insurers perform their jobs better and customers get appropriate rates, data also catches criminal activity. Customer relationship management software can search customers’ social profiles for any activity related to a claim, and predictive analytics is being used to spot trends in customer behavior that might be a red flag for fraud.

With the help of artificial intelligence (AI), large amounts of data can be reviewed more efficiently, allowing them to identify potential fraudsters before they cause any damage. AI can help humans identify potential risks associated with specific claims and better decide which insurance policies to buy. AI can help you manage your risk profile by monitoring trends and adjusting your strategy accordingly.

3. Leveraging Low-Code Capabilities:

Low-code is a software development approach that enables the delivery of applications quickly and with minimal hand-coding. Low-code digital platforms are an excessive solution for insurance companies that have an opportunity to accelerate their business growth. Low-code platforms can help manage claim processing, underwriting, and customer and agent portals more efficiently. Companies can apply low-code capabilities that let users drag and drop the functionality they need to build a specific digital platform. Investments in applications are kept low, but the benefits remain the same.

4. The Convenience of Transacting:

Customers expect a quick and instant resolution to their needs. Digital transactions offer the comfort of engaging in various insurance-related processes. Besides, online transactions can be processed anywhere and at any time, providing convenience to customers. Also, the digital insurance platform simplified the various insurance processes, from buying the policies to renewing, servicing, and filing claims, thereby augmenting the customer’s overall experience.

5. Competitive Advantage:

While the insurance world may not have been as fast to adapt to digital transformation as other industries, many companies, including insurance-focused tech companies, are adopting several digital tools and investing in emerging technologies such as AI/ML, IoT, Blockchain, etc. Digital technology allows customers to access their insurance policies smoothly, make claims, and pay their premiums, all in real time, in one place. This information is deposited and easily accessible in one digital system for you to automate where conceivable and make informed decisions where required. Insurance companies must invest in digital technology to keep pace with the market’s competition. You may gain an advantage if you implement an effective digital tool first.

6. Maintain Compliance and Regulatory:

Any mis-selling by insurance agents or brokers is eliminated as the customers can seamlessly purchase insurance or deal directly with the insurance company through the digital platform. Customers can compare insurance companies and their products and services before selecting the proper coverage.

Conclusion

The insurance and finance sectors are changing incredibly, thanks to next-generation technologies. In today’s competitive world, if companies need to succeed, they must cater to customers’ ever-changing needs, and a digital platform is a way to do that. Adopting suitable digital platform trends allows you to improve your operations while bringing agility and transparency to your business. That is why plugging into a digital platform is a very efficient option. To stay competitive, insurers and carriers must stay on top of trends and be positioned to take advantage of digital solutions and evolving technology.

Cigniti has end-to-end digital solutions that guarantee business participation by insurance companies in the digital landscape. Cigniti has extensive experience assisting with digital solutions while considering the needs of insurance companies and helping them gain a competitive advantage.

Need help? Schedule a discussion with our insurance domain experts to learn more about the opportunities that the digital solution brings to the insurance value chain.

Leave a Reply