5 Opportunities that the Metaverse Brings to the Insurance Value Chain

The metaverse is steering the next wave of digital transformation, which will provide insurers with powerful technology tools for differentiation as well as challenges to navigate. In the years ahead, the rise of the metaverse will begin to influence every facade of insurance, from the workforce experience to distribution, marketing, products, revenue pools, and operations. This would be an appropriate time to bring new and innovative insurance products and commercial insurance to the digital marketplace. Businesses that don’t adopt the metaverse today will end up playing catch-up when it comes to participating in and possibly taking advantage of the Metaverse.

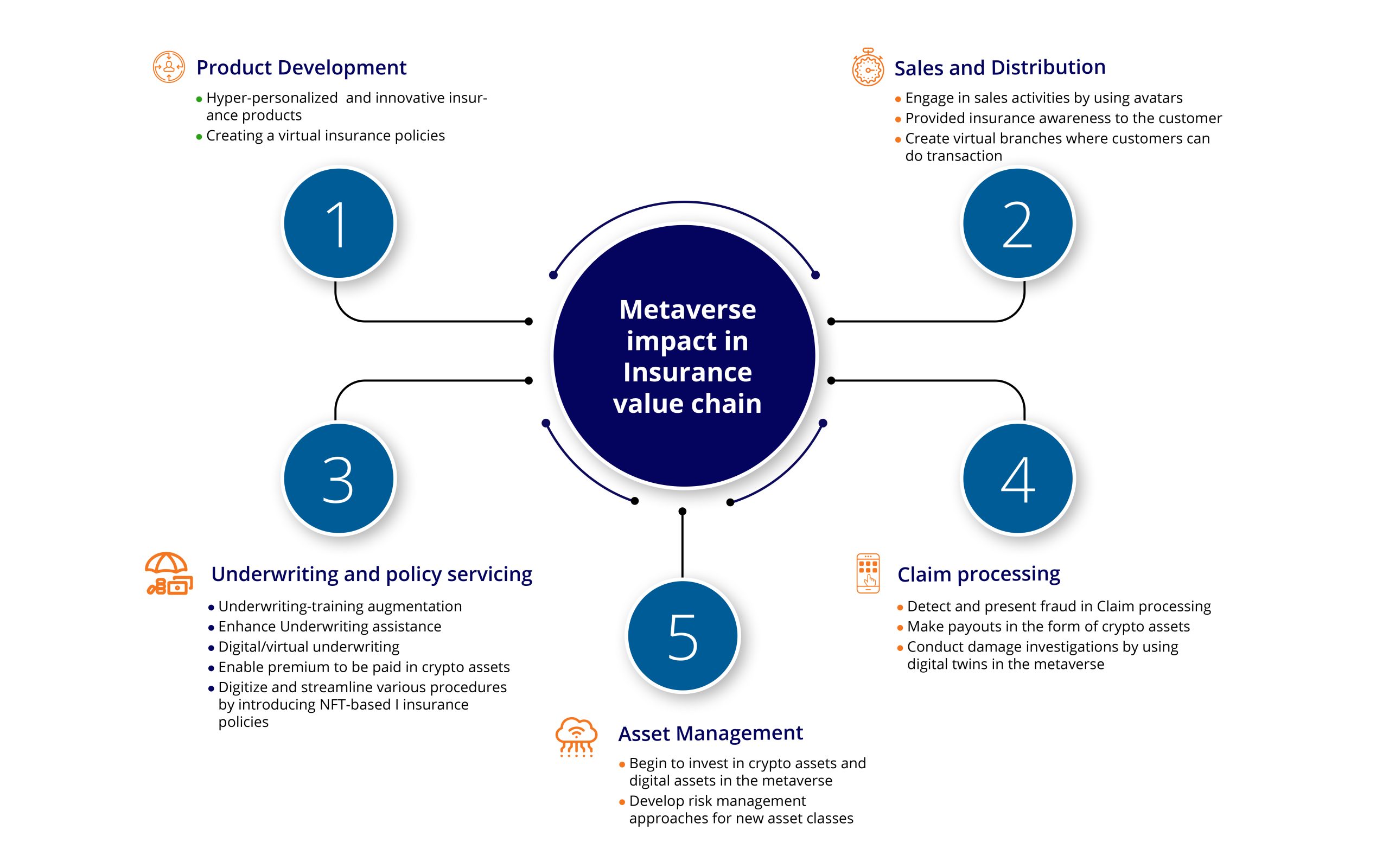

Metaverse’s Impact on the Insurance Value Chain

Here are the 5 opportunities that the Metaverse brings to the Insurance value chain.

New Product Development:

Today, more and more insurance companies are crafting a new strategy to develop insurance products in the metaverse. The aim is to offer customers an immersive digital experience by creating virtual insurance policies. The metaverse thus establishes a supplementary and innovative sales and distribution channel for the insurer’s products. Catering to this market segment is unlikely to significantly alter products or services; however, underwriters may be able to assess risk and loss more accurately using modeling techniques. People may want to insure their Metaverse lives and assets (in-game currencies and Metaverse assets). Specific products may need to be developed for Metaverse applications.

Metaverse will impact the health insurance sector and continue to grow in the future. It is not unrealistic to believe that healthcare companies will soon venture in to create new business models aligned with patient needs for health insurance and life insurance, reimbursements, health care, and prescriptions in this new virtual world. Monitoring of patient activity in the metaverse world means factors such as compliance and behavior could be tracked more effortlessly, which would further help the insurers contribute to customizing health insurance plans for the consumer based on specific coverages.

Sales and Distribution:

As the digital and physical worlds increasingly congregate, it is clear the metaverse is a real sales channel, and insurers need a targeted strategy. Insurers should develop a strategy to distinguish their digital and physical asset policy coverages and clarify what is covered and is not covered for these metaverse-based digital assets. The insurer should have a judicious understanding of what metaverse assets current and potential policyholders own, which will require a much deeper elicitation in the insurance underwriting process to ensure these newfangled risks are appropriately priced. Those insurers who start their metaverse journey sooner will develop the data structure needed to get their appropriate pricing right much faster.

Insurers could use the metaverse to visualize models and scenarios to bring real-life scenarios to life, adding emotional engagement to sales or marketing experiences. Recreating the trust and human touch of the agent sales experience, while announcing more visually appealing ways to help buyers understand product features, coverage, and trade-offs, could help accelerate the move to digital distribution channels, offering brand value and access to new, highly tech-savvy customer segments. Insurers provide financial consulting and health care services through their metaverse platform by creating virtual counseling spaces in the metaverse.

Underwriting:

Currently, there is a significant push towards more intelligent and smart underwriting. Today’s insurers can collect large amounts of data about policyholders and their habits and behaviors, which can be leveraged to obtain greater insight as to the risk of an individual/group on an ongoing basis. Harnessing these big data sets will empower insurers to better negotiate with reinsurers for better terms and rates and identify risk more accurately. This is a new form of smart and intelligent underwriting that has been discussed for years, but its applications are now finally coming to realization.

Property and casualty underwriters could use the new technology to examine assets without needing to be on site, thereby reducing costs and better assessing risk. Underwriters’ ideal situation is for them to thoroughly understand the nature of the risk and price it accurately. Metaverse technologies, which include VR and AR, will provide underwriters and loss adjusters with a more granular and accurate view of the risk involved than they could have imagined unless it occurred (e.g., damage estimation). It will also allow insurers to analyze the risk and be much more accurately rated (e.g., better modeling and risk assessment). Underwriting in the metaverse comes with numerous opportunities to tap the space in areas such as, Underwriting-training augmentation, enhance virtual underwriting assistance, digital/virtual underwriting, enable premiums to be paid in crypto assets, and digitize and restructure various procedures by introducing NFT-based insurance policies.

Claim Processing:

Metaverse headsets could be used to carry out property assessments and valuations by overlaying new damage information over pre-damage images to verify claim information and assessments. Metaverse can uncover new opportunities when it comes to property damage, helping claims investigators and loss adjusters use solutions that can spread over damaged areas and object parts with information and instructions to help third-party specialist providers perform repair operations remotely (e.g., assisted remote training and remote guidance) to reduce expenses and optimize the use of specialists’ time. Additional benefits for insurance companies include detecting and presenting fraud in claim processing, making payouts in the form of crypto assets, and conducting damage investigations by using digital twins in the metaverse.

Asset Management:

Metaverses are developing market-based virtual world economies with a continually evolving multipart mix of digital goods, services, and assets that generate real-world value for users. With the fruition of the metaverse, the ownership and adoption of transactions involving assets are also developing to increasingly make use of crypto-assets, digital payments, non-fungible tokens (NFTs), and digital assets. From the insurer’s point of view, the metaverse will change the risk approach and investment portfolios as investments increasingly occur both in the physical and virtual worlds. Insurance companies are already beginning to view crypto assets as investment vehicles, start focusing on alternative assets abroad, and consider crypto investments. Asset management in the metaverse comes with numerous opportunities for insurers to tap the space in areas such as investing in crypto assets and digital assets in the metaverse and developing risk management approaches for new asset classes.

Conclusion

The metaverse won’t interrupt the fundamentals of insurance processes and business, but it will almost certainly alter the relationship between insurers and insureds. As technology advances, benefits carriers will be able to provide robust digital coaching, hyper-personalized insurance benefit selection, collaborative digital wellness programs, and new and innovative products to meet the coverage needs of metaverse residents. Metaverse is a lot more than a technological shift that would open new sources of revenue. To stay competitive, insurers and carriers must stay on top of trends and be positioned to take advantage of the metaverse and evolving technology.

Cigniti has end-to-end virtual world solutions that guarantee business participation by insurance companies in the digital landscape. Cigniti has extensive experience assisting in metaverse solutions while considering the needs of insurance companies and helping them in gaining a competitive advantage.

Need help? Talk to our insurance domain experts to learn more about the opportunities that the metaverse brings to the insurance value chain.

Leave a Reply